The team has provided scant investigation to give cerdibility to it allege. I wouldn’t offer much credence to people statements, said James Shanahan, an expert which have Edward Jones just who comes after Berkshire Hathaway.

Yet somewhere else in financials, the organization discloses that merely money it considers non-performing are those already regarding foreclosure procedure. That implies the unbelievable-group of proportion ignores loans which can be unpaid and those that keeps already been foreclosed or even the homes repossessed.

Clayton’s failure prices is twenty six % within 21st Financial and you will 33 % at Vanderbilt, said Rishel, exactly who quoted their lookup and you may discussions having Clayton executives.

Along the community, on twenty-eight per cent off low-mortgage cellular home loans fail, based on search prepared for a market conference by Kenneth Rishel, a consultant who has worked around to possess 40 years

From inside the a brief current email address, 21st President Tim Williams said people wide variety was in fact wrong, however, he refuted to own businesses rates.

Berkshire reports Clayton as part of its lending products part as it tends to make the majority of its money from financing and you may insurance, maybe not out-of building and you may selling residential property, said Williams, who spent some time working in the Vanderbilt before beginning 21st and you can offering they right back so you can Clayton.

The firm try successful in every it can, the guy told you when you look at the a job interview a year ago, but lending products is in which the money is produced.

Buffett happily trumpets Berkshire’s decentralized framework, claiming the guy delegates so you’re able to Ceos instance payday loans online Colorado Kevin Clayton nearly concise regarding abdication. At the Clayton Home, the end result could have been lax supervision of some of their investors. In Texas, such, countless signatures were forged to simply help secure finance for all of us and no assets, a habit you to Vanderbilt’s after that-chairman, Paul Nichols, recognized and you will told you is deplorable in later on demo testimony.

Clayton’s questionable practices longer so you can their dealers, said Kevin Carroll, the previous dealer exactly who acquired Clayton honors to own his conversion process results.

Chief executive officer Kevin Clayton helped Carroll score that loan away from 21st Mortgage to get aside his organization people into the 2008, Carroll said. Two weeks adopting the financing data were signed, Clayton Homes told Carroll it was shuttering the nearby manufacturing plant one to supplied his dealer.

The brand new closure destined Carroll’s providers. The guy dropped about into the their costs. Clayton agencies tormented your that have limitless phone calls, he said, until the guy agreed in 2010 so you can quit the firm as well as the residential property underneath it. Carroll sued, nevertheless instance are thrown out as a lot of time got elapsed.

They entrap your, Carroll told you. They give you a loan that you are unable to pay and you will chances are they grab from you.

(This facts could have been upgraded in order to echo a response create of the Clayton Property following the facts was composed. Follow this link having a diagnosis out of Clayton’s says.)?

Over several Clayton customers demonstrated a typical selection of inaccurate means you to closed all of them toward ruinous purchases: mortgage conditions one to altered quickly once they paid off places or prepared homes for their new home; surprise charges tacked to finance; and you will stress to consider extreme payments considering incorrect promises that they you certainly will later re-finance.

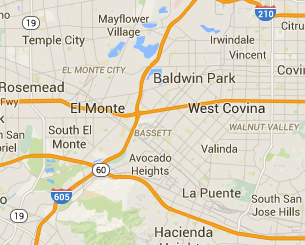

Within the Texas, the number is higher than seventy percent. Clayton has more 90 per cent of field into the Odessa, perhaps one of the most costly towns in the nation to finance a cellular household.

Clayton offered more than half of brand new mobile-mortgage brokers inside the eight states

Mansfield had a lousy credit history away from 474, court records tell you. Even if she had seasonal and you may part-time efforts, their own month-to-month earnings usually contained below $700 into the handicap professionals. She didn’t come with currency getting an advance payment whenever she went along to Clayton Home from inside the Fayetteville, Letter.C.

Nine Clayton customers questioned because of it story told you these people were assured a way to re-finance. In reality, Clayton hardly ever refinances financing and accounts for better lower than step one percent out of mobile-home refinancings reported for the bodies study from 2010 to 2013. It produced several-3rd of the get money through that period.

Shortly after Pitts’ spouse, Kirk, was clinically determined to have competitive cancer, she said, a good Vanderbilt representative told her she want to make the house payment their particular first priority and let scientific debts wade outstanding. She said the company features threatened to seize their own possessions immediately, although the court way to exercise manage just take during the least period.

During the a letter to help you shareholders past times, Buffett composed one an excellent high portion of [Clayton’s] consumers kept their homes in the 2008 houses crisis and ensuing recession, by way of sensible financing techniques that were, he’s told you, much better than its biggest competitors.